Contents

- Base Parameters - Table 2

- Other definitions

- Functions of interest

- Example 1: good equilibirum of Keen model without policy rate

- Example 2: bad equilibrium of Keen model without policy rate

- Example 3: good equilibrium with policy rate

- Example 4: stabilizaing policy rate with high debt levels

- Example 5: stabilizaing policy rate with higher debt levels

- Auxiliary functions

function out = negative_paper()

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%% % This code simulates the Keen model with monetary policy as % specified in Grasselli and Lipton (2019) % % authors: M. Grasselli and A. Lipton %%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%% close all clc warning off

Base Parameters - Table 2

a = -0.0401; % constant parameter in phillips curve b_phil = 0.0001;% coefficient phillips curve c = -0.0065; % constant parameter in investment function d_i = -5; % affine parameter in exponent of investment function e = 20; % coefficient in the exponent of investment function kr= 0.1; % capital ratio for banks (loan/equity) markup = 1.3; % markup factor alpha = 0.025; % growth rate in productivity beta =0.02; % growth rate in population gamma=0.8; % money illusion coefficient delta=0.03; % depreciation rate etap=0.35; % inflation relaxation parameter nu=3; % capital to output ratio

Other definitions

TOL = 1E-7; options = odeset('RelTol', TOL); txt_format = '%3.3g';

Functions of interest

inflation = @(x) etap*(markup*x-1); % inflation, equation (10) phillips = @(x) a+b_phil./(1-x).^2; % Phillips curve, equation (24) investment= @(x) c+exp(d_i+e.*x); % investment function, equation (25)

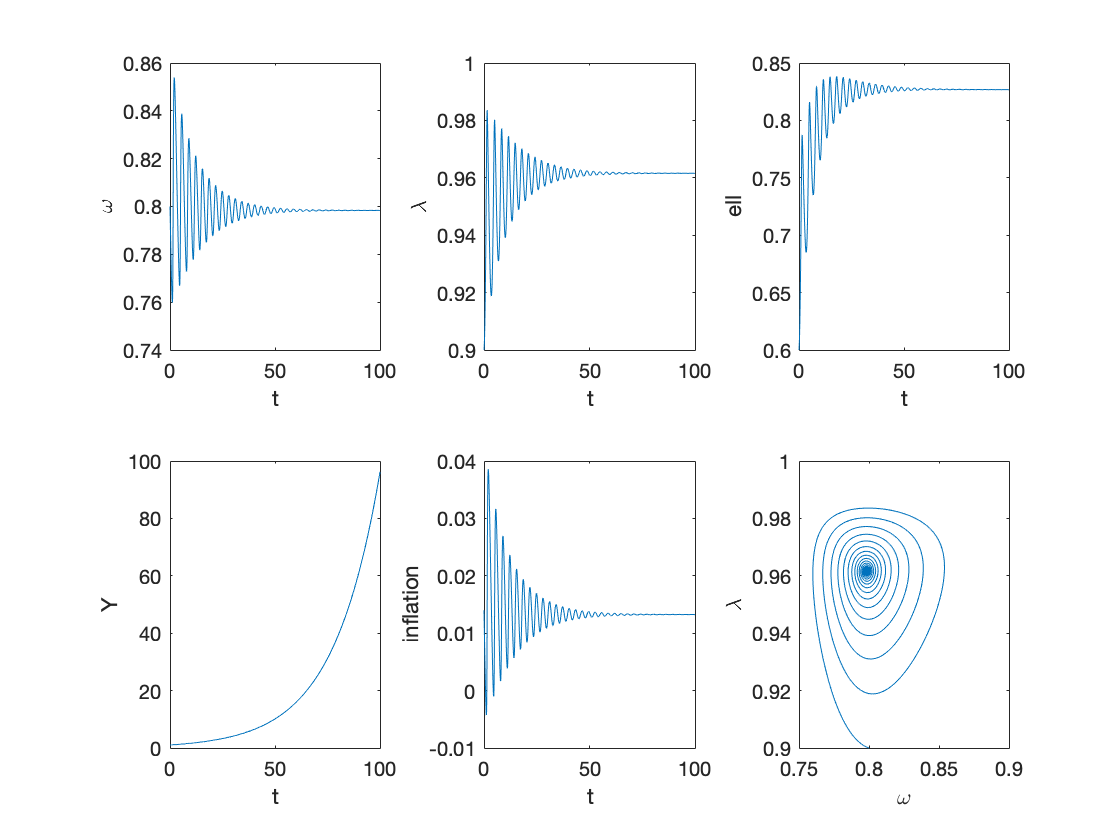

Example 1: good equilibirum of Keen model without policy rate

tax=0; % tax to income ratio g=0; % government spending to income ratio etag=0; % speed of adjustment of rho etar=0; % speed of adjustment of rg deltar=0.03; % interest rate spread T=100; omega0=0.8; lambda0=0.9; l0=0.6; rho0=0; rg0=0; b0=0; Y0=1; y0=[convert([omega0,lambda0]),l0,rho0,rg0,b0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); Y_output = Y0*yK(:,2)/lambda0.*exp((alpha+beta)*tK); % Figure 2 figure subplot(2,3,1) plot(tK,yK(:,1)) xlabel('t') ylabel('\omega') subplot(2,3,2) plot(tK,yK(:,2)) xlabel('t') ylabel('\lambda') subplot(2,3,3) plot(tK,yK(:,3)) xlabel('t') ylabel('ell') subplot(2,3,4) plot(tK,Y_output) xlabel('t') ylabel('Y') inflation_sol=inflation(yK(:,1)); subplot(2,3,5) plot(tK,inflation_sol) xlabel('t') ylabel('inflation') subplot(2,3,6) plot(yK(:,1),yK(:,2)) xlabel('\omega') ylabel('\lambda')

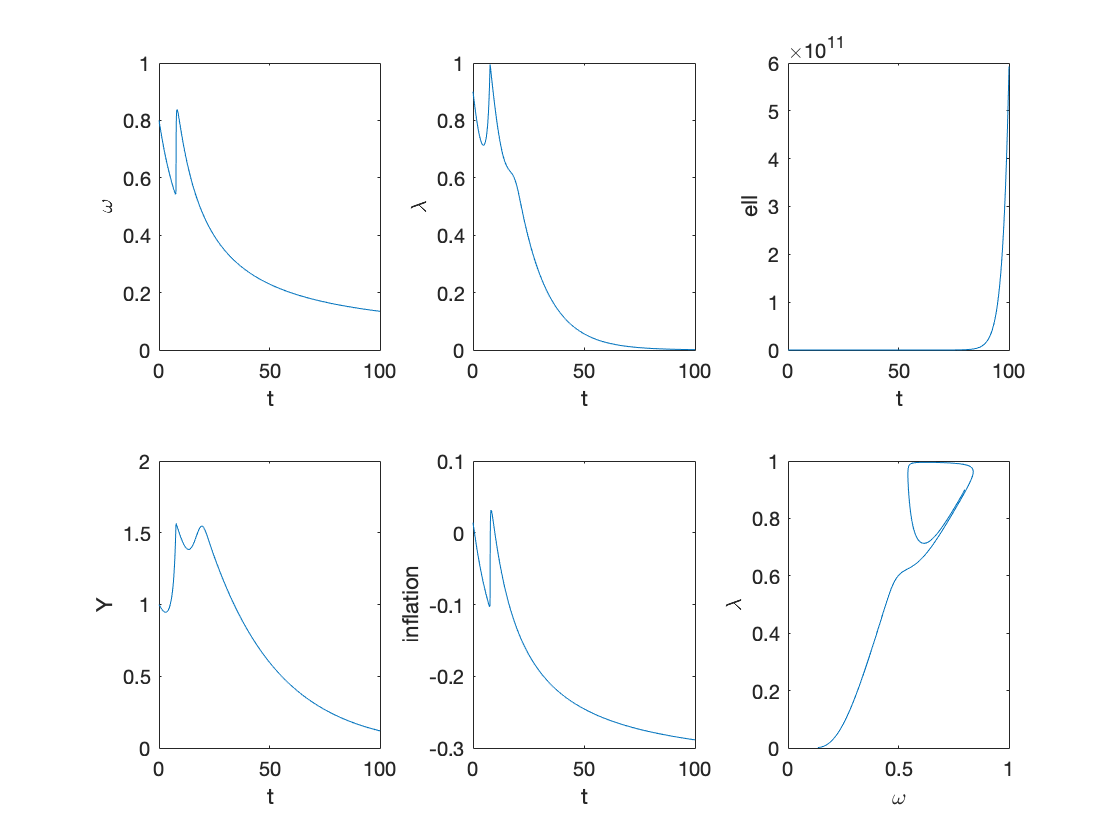

Example 2: bad equilibrium of Keen model without policy rate

tax=0; % tax to income ratio g=0; % government spending to income ratio etag=0; % speed of adjustment of rho etar=0; % speed of adjustment of rg deltar=0.03; % interest rate spread T=100; omega0=0.8; lambda0=0.9; l0=6; % NOTE: this is incorrectly listed in the paper as l0 = 0.6 rho0=0; rg0=0; b0=0; Y0=1; y0=[convert([omega0,lambda0]),l0,rho0,rg0,b0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); Y_output = Y0*yK(:,2)/lambda0.*exp((alpha+beta)*tK); % Figure 3 figure subplot(2,3,1) plot(tK,yK(:,1)) xlabel('t') ylabel('\omega') subplot(2,3,2) plot(tK,yK(:,2)) xlabel('t') ylabel('\lambda') subplot(2,3,3) plot(tK,yK(:,3)) xlabel('t') ylabel('ell') subplot(2,3,4) plot(tK,Y_output) xlabel('t') ylabel('Y') inflation_sol=inflation(yK(:,1)); subplot(2,3,5) plot(tK,inflation_sol) xlabel('t') ylabel('inflation') subplot(2,3,6) plot(yK(:,1),yK(:,2)) xlabel('\omega') ylabel('\lambda')

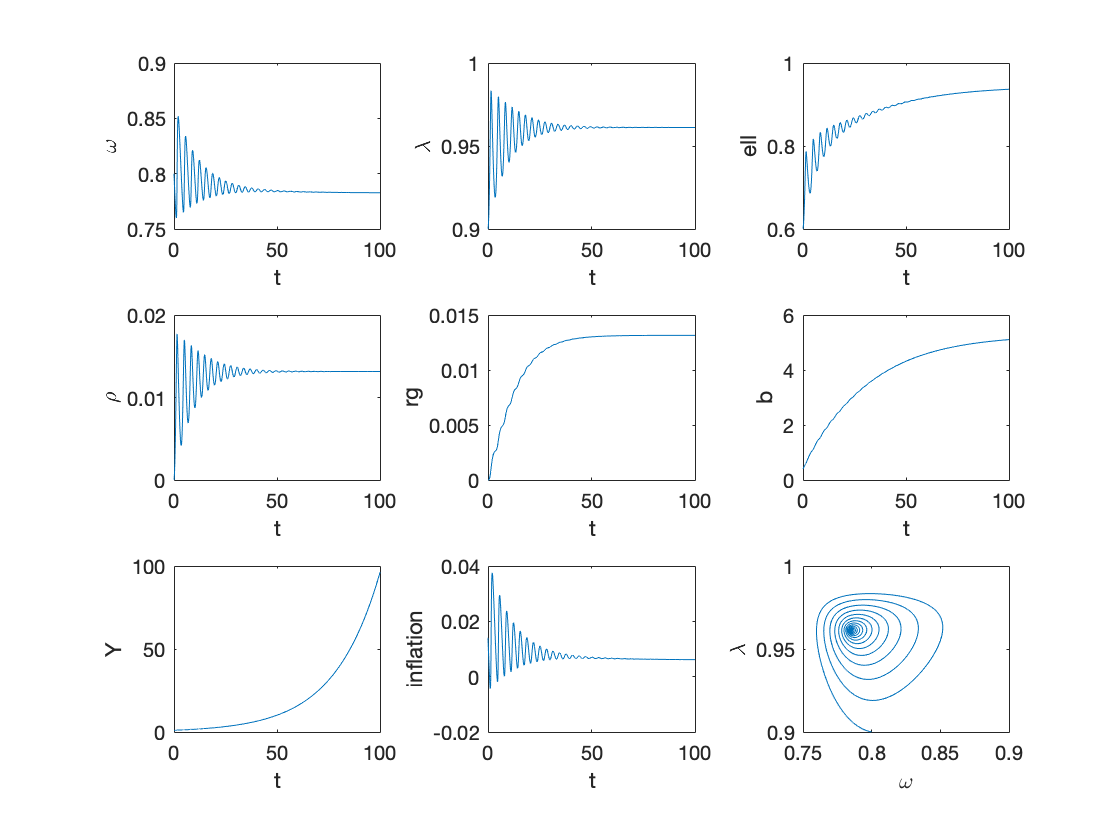

Example 3: good equilibrium with policy rate

tax=0; % tax to income ratio g=0.2; % government spending to income ratio etag=0.2; % speed of adjustment of rho etar=0.1; % speed of adjustment of rg deltar=0.03; % interest rate spread T=100; omega0=0.8; lambda0=0.9; l0=0.6; rho0=0; rg0=0; b0=0.4; Y0=1; y0=[convert([omega0,lambda0]),l0,rho0,rg0,b0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); Y_output = Y0*yK(:,2)/lambda0.*exp((alpha+beta)*tK); % Figure 4 figure subplot(3,3,1) plot(tK,yK(:,1)) xlabel('t') ylabel('\omega') subplot(3,3,2) plot(tK,yK(:,2)) xlabel('t') ylabel('\lambda') subplot(3,3,3) plot(tK,yK(:,3)) xlabel('t') ylabel('ell') subplot(3,3,4) plot(tK,yK(:,4)) xlabel('t') ylabel('\rho') subplot(3,3,5) plot(tK,yK(:,5)) xlabel('t') ylabel('rg') subplot(3,3,6) plot(tK,yK(:,6)) xlabel('t') ylabel('b') subplot(3,3,7) plot(tK,Y_output) xlabel('t') ylabel('Y') inflation_sol=inflation(yK(:,1)); subplot(3,3,8) plot(tK,inflation_sol) xlabel('t') ylabel('inflation') subplot(3,3,9) plot(yK(:,1),yK(:,2)) xlabel('\omega') ylabel('\lambda')

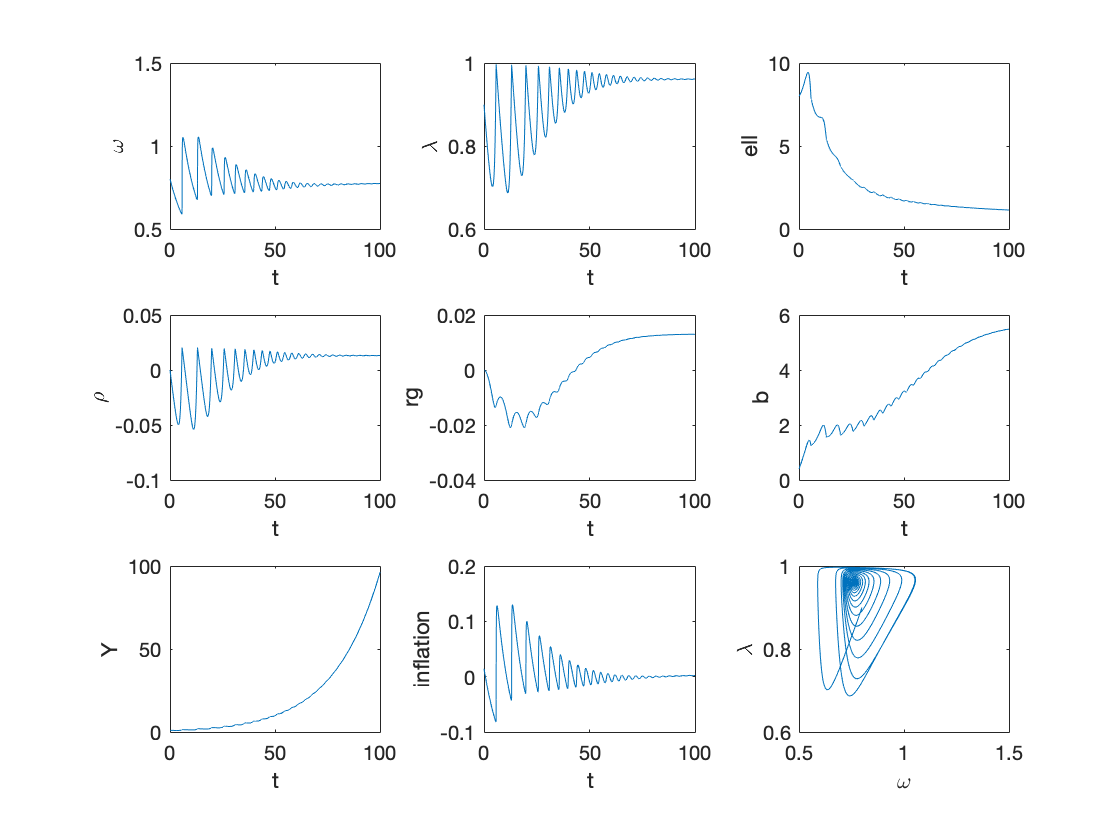

Example 4: stabilizaing policy rate with high debt levels

tax=0; % tax to income ratio g=0.2; % government spending to income ratio etag=0.2; % speed of adjustment of rho etar=0.1; % speed of adjustment of rg deltar=0.03; % interest rate spread T=100; omega0=0.8; lambda0=0.9; l0=6; rho0=0; rg0=0; b0=0.4; Y0=1; y0=[convert([omega0,lambda0]),l0,rho0,rg0,b0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); Y_output = Y0*yK(:,2)/lambda0.*exp((alpha+beta)*tK); % Figure 5 figure subplot(3,3,1) plot(tK,yK(:,1)) xlabel('t') ylabel('\omega') subplot(3,3,2) plot(tK,yK(:,2)) xlabel('t') ylabel('\lambda') subplot(3,3,3) plot(tK,yK(:,3)) xlabel('t') ylabel('ell') subplot(3,3,4) plot(tK,yK(:,4)) xlabel('t') ylabel('\rho') subplot(3,3,5) plot(tK,yK(:,5)) xlabel('t') ylabel('rg') subplot(3,3,6) plot(tK,yK(:,6)) xlabel('t') ylabel('b') subplot(3,3,7) plot(tK,Y_output) xlabel('t') ylabel('Y') inflation_sol=inflation(yK(:,1)); subplot(3,3,8) plot(tK,inflation_sol) xlabel('t') ylabel('inflation') subplot(3,3,9) plot(yK(:,1),yK(:,2)) xlabel('\omega') ylabel('\lambda')

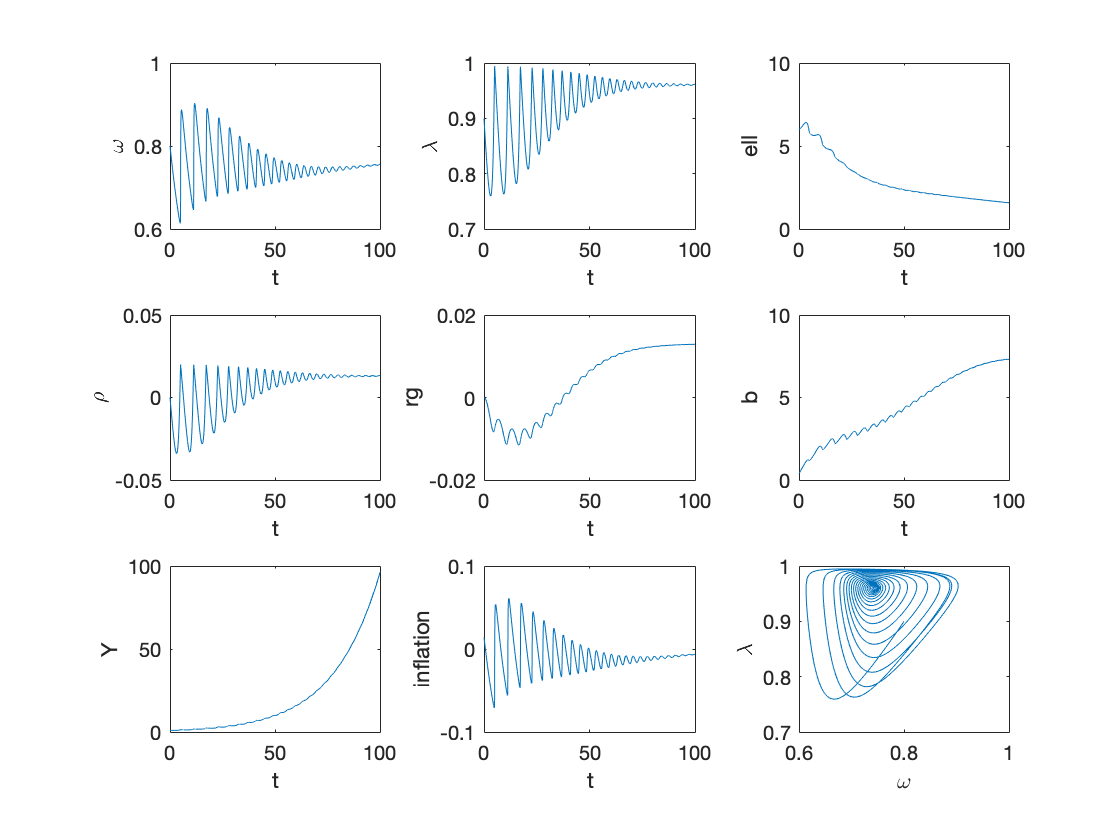

Example 5: stabilizaing policy rate with higher debt levels

tax=0; % tax to income ratio g=0.2; % government spending to income ratio etag=0.2; % speed of adjustment of rho etar=0.1; % speed of adjustment of rg deltar=0.03; % interest rate spread T=100; omega0=0.8; lambda0=0.9; l0=8; rho0=0; rg0=0; b0=0.4; Y0=1; y0=[convert([omega0,lambda0]),l0,rho0,rg0,b0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); Y_output = Y0*yK(:,2)/lambda0.*exp((alpha+beta)*tK); % Figure 6 figure subplot(3,3,1) plot(tK,yK(:,1)) xlabel('t') ylabel('\omega') subplot(3,3,2) plot(tK,yK(:,2)) xlabel('t') ylabel('\lambda') subplot(3,3,3) plot(tK,yK(:,3)) xlabel('t') ylabel('ell') subplot(3,3,4) plot(tK,yK(:,4)) xlabel('t') ylabel('\rho') subplot(3,3,5) plot(tK,yK(:,5)) xlabel('t') ylabel('rg') subplot(3,3,6) plot(tK,yK(:,6)) xlabel('t') ylabel('b') subplot(3,3,7) plot(tK,Y_output) xlabel('t') ylabel('Y') inflation_sol=inflation(yK(:,1)); subplot(3,3,8) plot(tK,inflation_sol) xlabel('t') ylabel('inflation') subplot(3,3,9) plot(yK(:,1),yK(:,2)) xlabel('\omega') ylabel('\lambda')

Auxiliary functions

Instead of integrating the system in terms of omega, lambda and d, we decided to use:

log_omega = log(omega), tan_lambda = tan((lambda-0.5)*pi)

Experiments show that the numerical methods work better with these variables.

function new = convert(old) % This function converts % [omega, lambda] % to % [log_omega, tan_lambda] n = size(old,2); %number of variables new = zeros(size(old)); new(:,1) = log(old(:,1)); new(:,2) = tan((old(:,2)-0.5)*pi); end function old = retrieve(new) % This function retrieves [omega, lambda] % from % [log_omega, tan_lambda] n = size(new,2); %number of variables old = zeros(size(new)); old(:,1) = exp(new(:,1)); old(:,2) = atan(new(:,2))/pi+0.5; end function f = main(y) % solves the main dynamical system f = zeros(6,1); log_omega = y(1); tan_lambda = y(2); l = y(3); rho= y(4); rg=y(5); b=y(6); lambda = atan(tan_lambda)/pi+0.5; omega = exp(log_omega); profit = 1-omega-tax-(rg+deltar)*l; growth = investment(profit)/nu-delta; % real growth rate % Equation (13) f(1) = phillips(lambda)-(1-gamma)*inflation(omega)-alpha; %d(log_omega)/dt f(2) = (1+tan_lambda^2)*pi*lambda*(growth-alpha-beta); %d(tan_lambda)/dt f(3) = (rg+deltar-growth-inflation(omega))*l+omega+tax+investment(profit)-1; %d(l)/dt f(4) = etag*(growth-alpha-beta); %d(rho)/dt f(5) = etar*(rho-rg); %d(rg)/dt % Equation (18) f(6) = (g-tax)+b*(rg-inflation(omega)-growth); %db/dt end

end