Contents

- Base Parameters - Table 2

- Base initial conditions

- Other definitions

- Functions of interest

- Numerical Values of Interest

- Example 1 - fractional banking with finite equilibrium

- Example 2 - fractional banking with explosive equilibrium

- Example 3 - narrow banking with finite equilibirum

- Example 4 - narrow banking with explosive equilibirum

- Auxiliary functions

function out = narrow_paper()

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%% % This code simulates the fractional and narrow banking models as % specified in Grasselli and Lipton (2019) % % authors: M. Grasselli and A. Lipton %%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%% close all clc warning off

Base Parameters - Table 2

r = 0.03; %interest rate on loans NOTE: this is listed incorrectly as 0.04 in the paper rd = 0.02; %interest rate time deposits rtheta = 0.012; % interest rate on bills rm = 0.01; %interest rate on demand deposits lambda10 = 0.3; % portfolio parameters for households lambda20 = 0.3; lambda30 = 0.3; lambda11 = 4; lambda12 = -1; lambda22 = 2; alpha = 0.025; %productivity growth rate beta = 0.02; %population growth rate eta_p = 0.35; % adjustment speed for prices markup = 1.65; % mark-up value gamma = 0.8; % inflation sensitivity in the bargaining equation g = 0.2; % government spending tax = 0.08; % taxation nu = 3; %capital to output ratio delta = 0.05; %depreciation rate kr = 0.08; % capital adequacy ratio phi0 = 0.0401; %Phillips curve parameter phi1 = 6.41e-05; %Phillips curve parameter kappa0 = -0.0065; %investment parameters kappa1 = 0.8; kappa2 = 1; kappa3 = 1; % NOTE: this is incorrectly listed in the paper as kappa3 = 2 kappa4 = 10; xi = 4; lambda00 = 1-(lambda10+lambda20+lambda30); % proportion of households savings invested in cash lambda1 = lambda10+lambda11*rtheta+lambda12*rm-(lambda11+lambda12)*rd; % proportion of households savings invested bills lambda2 = lambda20+lambda12*rtheta+lambda22*rm-(lambda12+lambda22)*rd; % proportion of households savings invested demand deposits lambda3 = lambda30-(lambda11+lambda12)*rtheta-(lambda12+lambda22)*rm+(lambda11+2*lambda12+lambda22)*rd; % proportion of households savings invested in time deposits

Base initial conditions

omega0 = 0.6; lambda0 = 0.9; Y0=100; h0= 0.2; thetah0 = 0.5; mh0 = 0.2; thetab0 = 0.1;

Other definitions

TOL = 1E-7; options = odeset('RelTol', TOL); txt_format = '%3.3g';

Functions of interest

inflation = @(x) eta_p*(markup*x-1); % inflation, equation (2.64) phillips = @(x) phi1./(1-x).^2- phi0; % Phillips curve, equation (2.65) phillips_prime = @(x) 2*phi1./(1-x).^3; % derivative of phillips curve phillips_inv = @(x) 1 - (phi1./(x+phi0)).^(1/2); % inverse of phillips curve investment= @(x) kappa0+kappa1./(kappa2+kappa3.*exp(-kappa4*x)).^xi; % investment function, equation (2.66) % derivative of investment function investment_prime= @(x) xi*kappa1*kappa3.*kappa4.*exp(-kappa4*x)./(kappa2+kappa3.*exp(-kappa4*x)).^(xi+1); % inverse of investment function investment_inv = @(x) -log(((kappa1./(x-kappa0)).^(1/xi)-kappa2)/kappa3)/kappa4;

Numerical Values of Interest

pi_eq=investment_inv(nu*(alpha+beta+delta)) % profit share at interior equilibrium, equation (2.73)

pi_eq =

0.1248

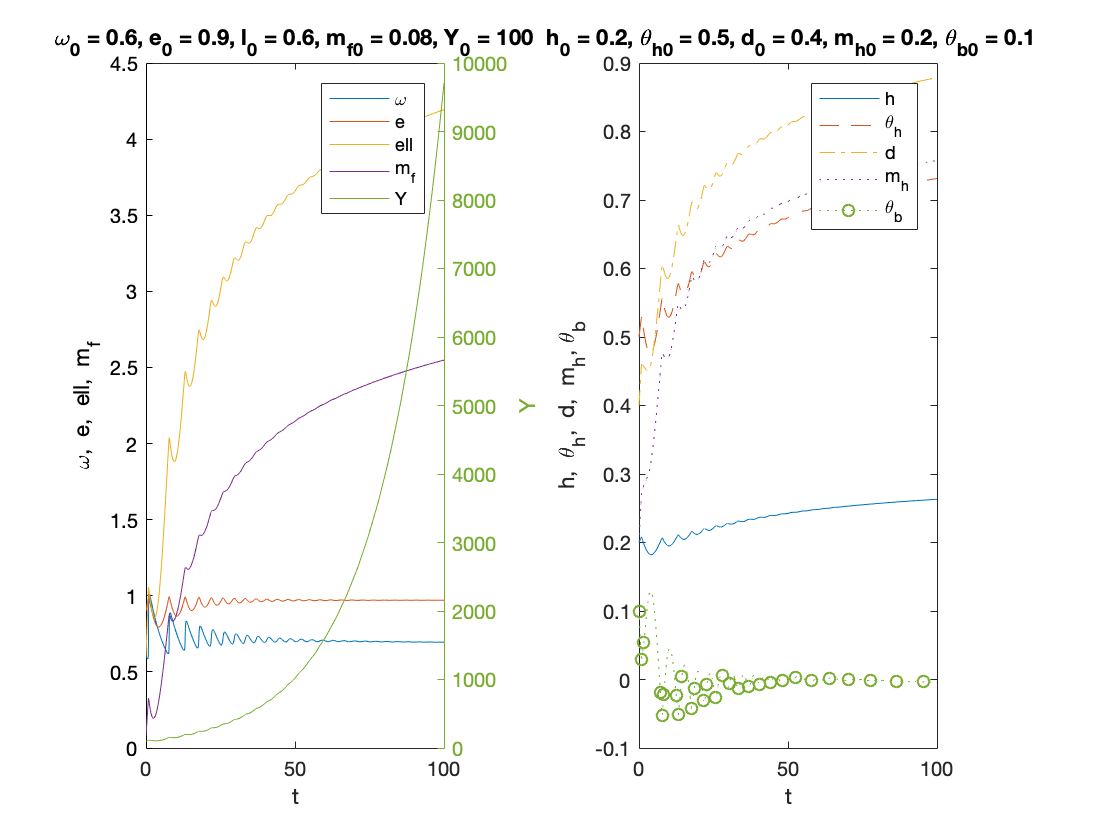

Example 1 - fractional banking with finite equilibrium

fR = 0.1; % reserve ratio d0 = 0.4; l0 = 0.6; mf0 = ((1-kr)*l0+thetab0+(fR-1)*mh0-d0)/(1-fR); cf0 = r*l0-rm*mf0; T =100; y0=[convert([omega0,lambda0]),l0,mf0,h0,thetah0,thetab0,mh0,d0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); omega_sol=sol(:,1); lambda_sol=sol(:,2); l_sol=yK(:,3); mf_sol=yK(:,4); h_sol=yK(:,5); theta_h_sol=yK(:,6); theta_b_sol=yK(:,7); mh_sol=yK(:,8); d_sol=yK(:,9); profit_sol = 1-tax-omega_sol-r*l_sol+rm*mf_sol; Y_output = Y0*lambda_sol/lambda0.*exp((alpha+beta)*tK); xb=l_sol+fR*(mh_sol+mf_sol)+theta_b_sol-(d_sol+mh_sol+mf_sol); k_effective = xb./l_sol; n=length(yK(:,1)); omega_bar = omega_sol(n); lambda_bar = lambda_sol(n); l_bar = l_sol(n); mf_bar = mh_sol(n); profit_bar = profit_sol(n); investment_bar = investment(profit_bar); growth_bar = investment_bar/nu -delta; inflation_bar = inflation(omega_bar); F1=phillips(lambda_bar)-(1-gamma)*inflation_bar-alpha; F2=growth_bar-alpha-beta; F3=-(growth_bar+inflation_bar)*l_bar+investment_bar+r*l_bar; fprintf('\nExample 1 - fractional banking with finite equilibirum \n') fprintf('omega = %f \n',omega_bar) fprintf('e = %f \n',lambda_bar) fprintf('l = %f \n',l_bar) fprintf('mf = %f \n',mf_bar) fprintf('profit = %f \n',profit_bar) fprintf('investment = %f \n',investment_bar) fprintf('growth = %f \n',growth_bar) fprintf('inflation = %f \n',inflation_bar) figure(1) subplot(1,2,1) plot(tK, omega_sol,tK,lambda_sol,tK,l_sol,tK,mf_sol) xlabel('t') ylabel('\omega, e, ell, m_f') yyaxis right plot(tK, Y_output) ylabel('Y') title(['\omega_0 = ', num2str(omega0,txt_format), ... ', e_0 = ', num2str(lambda0, txt_format), ... ', l_0 = ', num2str(l0, txt_format),... ', m_{f0} = ', num2str(mf0,txt_format),... ', Y_0 = ', num2str(Y0, txt_format)]) legend('\omega', 'e', 'ell', 'm_f','Y') %%%%%%%%%%% subplot(1,2,2) plot(tK,h_sol,tK,theta_h_sol,'--',tK,d_sol,'-.',tK,mh_sol,':',tK, theta_b_sol,':o','MarkerIndices',1:100:length(h_sol)) xlabel('t') ylabel('h, \theta_h, d, m_h, \theta_b') title([' h_0 = ', num2str(h0, txt_format),... ', \theta_{h0} = ', num2str(thetah0, txt_format),... ', d_0 = ', num2str(d0, txt_format),... ', m_{h0} = ', num2str(mh0,txt_format),... ', \theta_{b0} = ', num2str(thetab0,txt_format)]) legend('h','\theta_h','d', 'm_h','\theta_b') print('example1','-dpdf')

Example 1 - fractional banking with finite equilibirum omega = 0.694728 e = 0.970586 l = 4.193678 mf = 0.757731 profit = 0.124946 investment = 0.285402 growth = 0.045134 inflation = 0.051205

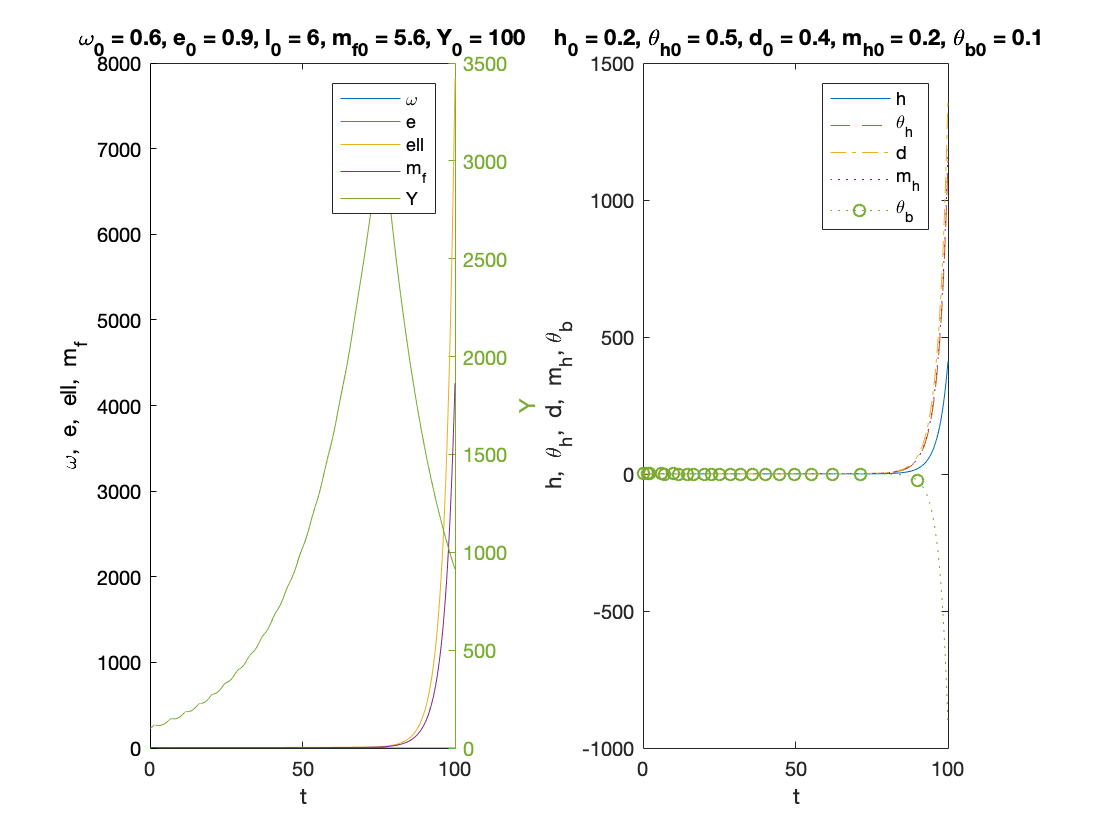

Example 2 - fractional banking with explosive equilibrium

fR = 0.1; % reserve ratio d0 = 0.4; l0 = 6; mf0 = ((1-kr)*l0+thetab0+(fR-1)*mh0-d0)/(1-fR); cf0 = r*l0-rm*mf0; T =100; y0=[convert([omega0,lambda0]),l0,mf0,h0,thetah0,thetab0,mh0,d0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); omega_sol=sol(:,1); lambda_sol=sol(:,2); l_sol=yK(:,3); mf_sol=yK(:,4); h_sol=yK(:,5); theta_h_sol=yK(:,6); theta_b_sol=yK(:,7); mh_sol=yK(:,8); d_sol=yK(:,9); profit_sol = 1-tax-omega_sol-r*l_sol+rm*mf_sol; Y_output = Y0*lambda_sol/lambda0.*exp((alpha+beta)*tK); xb=l_sol+fR*(mh_sol+mf_sol)+theta_b_sol-(d_sol+mh_sol+mf_sol); k_effective = xb./l_sol; n=length(yK(:,1)); omega_bar = omega_sol(n); lambda_bar = lambda_sol(n); l_bar = l_sol(n); mf_bar = mh_sol(n); profit_bar = profit_sol(n); investment_bar = investment(profit_bar); growth_bar = investment_bar/nu -delta; inflation_bar = inflation(omega_bar); F1=phillips(lambda_bar)-(1-gamma)*inflation_bar-alpha; F2=growth_bar-alpha-beta; F3=-(growth_bar+inflation_bar)*l_bar+investment_bar+r*l_bar; fprintf('\nExample 2 - fractional banking with explosive equilibirum \n') fprintf('omega = %f \n',omega_bar) fprintf('e = %f \n',lambda_bar) fprintf('l = %f \n',l_bar) fprintf('mf = %f \n',mf_bar) fprintf('profit = %f \n',profit_bar) fprintf('investment = %f \n',investment_bar) fprintf('growth = %f \n',growth_bar) fprintf('inflation = %f \n',inflation_bar) figure(2) subplot(1,2,1) plot(tK, omega_sol,tK,lambda_sol,tK,l_sol,tK,mf_sol) xlabel('t') ylabel('\omega, e, ell, m_f') yyaxis right plot(tK, Y_output) ylabel('Y') title(['\omega_0 = ', num2str(omega0,txt_format), ... ', e_0 = ', num2str(lambda0, txt_format), ... ', l_0 = ', num2str(l0, txt_format),... ', m_{f0} = ', num2str(mf0,txt_format),... ', Y_0 = ', num2str(Y0, txt_format)]) legend('\omega', 'e', 'ell', 'm_f','Y') %%%%%%%%%%% subplot(1,2,2) plot(tK,h_sol,tK,theta_h_sol,'--',tK,d_sol,'-.',tK,mh_sol,':',tK, theta_b_sol,':o','MarkerIndices',1:100:length(h_sol)) xlabel('t') ylabel('h, \theta_h, d, m_h, \theta_b') title([' h_0 = ', num2str(h0, txt_format),... ', \theta_{h0} = ', num2str(thetah0, txt_format),... ', d_0 = ', num2str(d0, txt_format),... ', m_{h0} = ', num2str(mh0,txt_format),... ', \theta_{b0} = ', num2str(thetab0,txt_format)]) legend('h','\theta_h','d', 'm_h','\theta_b') print('example2','-dpdf') %%%%%%%%%%%

Example 2 - fractional banking with explosive equilibirum omega = 0.218466 e = 0.091358 l = 7819.682877 mf = 1184.538737 profit = -191.283881 investment = -0.006500 growth = -0.052167 inflation = -0.223836

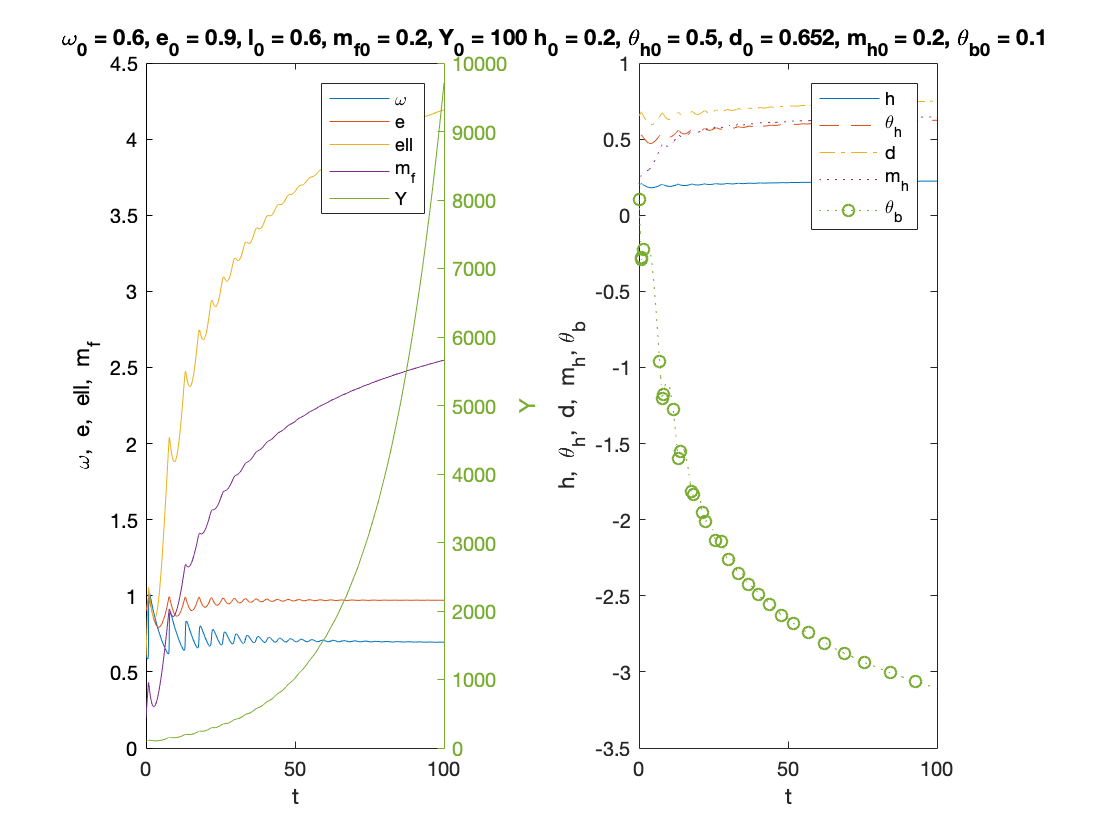

Example 3 - narrow banking with finite equilibirum

fR = 1; % reserve ratio mf0 = 0.2; l0 = 0.6; d0 = (1-kr)*l0+thetab0; cf0 = r*l0-rm*mf0; T =100; y0=[convert([omega0,lambda0]),l0,mf0,h0,thetah0,thetab0,mh0,d0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); omega_sol=sol(:,1); lambda_sol=sol(:,2); l_sol=yK(:,3); mf_sol=yK(:,4); h_sol=yK(:,5); theta_h_sol=yK(:,6); theta_b_sol=yK(:,7); mh_sol=yK(:,8); d_sol=yK(:,9); profit_sol = 1-tax-omega_sol-r*l_sol+rm*mf_sol; Y_output = Y0*lambda_sol/lambda0.*exp((alpha+beta)*tK); xb=l_sol+fR*(mh_sol+mf_sol)+theta_b_sol-(d_sol+mh_sol+mf_sol); k_effective = xb./l_sol; n=length(yK(:,1)); omega_bar = omega_sol(n); lambda_bar = lambda_sol(n); l_bar = l_sol(n); mf_bar = mh_sol(n); profit_bar = profit_sol(n); investment_bar = investment(profit_bar); growth_bar = investment_bar/nu -delta; inflation_bar = inflation(omega_bar); F1=phillips(lambda_bar)-(1-gamma)*inflation_bar-alpha; F2=growth_bar-alpha-beta; F3=-(growth_bar+inflation_bar)*l_bar+investment_bar+r*l_bar; fprintf('\nExample 3 - narrow banking with finite equilibirum \n') fprintf('omega = %f \n',omega_bar) fprintf('e = %f \n',lambda_bar) fprintf('l = %f \n',l_bar) fprintf('mf = %f \n',mf_bar) fprintf('profit = %f \n',profit_bar) fprintf('investment = %f \n',investment_bar) fprintf('growth = %f \n',growth_bar) fprintf('inflation = %f \n',inflation_bar) figure(3) subplot(1,2,1) plot(tK, omega_sol,tK,lambda_sol,tK,l_sol,tK,mf_sol) xlabel('t') ylabel('\omega, e, ell, m_f') yyaxis right plot(tK, Y_output) ylabel('Y') title(['\omega_0 = ', num2str(omega0,txt_format), ... ', e_0 = ', num2str(lambda0, txt_format), ... ', l_0 = ', num2str(l0, txt_format),... ', m_{f0} = ', num2str(mf0,txt_format),... ', Y_0 = ', num2str(Y0, txt_format)]) legend('\omega', 'e', 'ell', 'm_f','Y') %%%%%%%%%%% subplot(1,2,2) plot(tK,h_sol,tK,theta_h_sol,'--',tK,d_sol,'-.',tK,mh_sol,':',tK, theta_b_sol,':o','MarkerIndices',1:100:length(h_sol)) xlabel('t') ylabel('h, \theta_h, d, m_h, \theta_b') title([' h_0 = ', num2str(h0, txt_format),... ', \theta_{h0} = ', num2str(thetah0, txt_format),... ', d_0 = ', num2str(d0, txt_format),... ', m_{h0} = ', num2str(mh0,txt_format),... ', \theta_{b0} = ', num2str(thetab0,txt_format)]) legend('h','\theta_h','d', 'm_h','\theta_b') print('example3','-dpdf')

Example 3 - narrow banking with finite equilibirum omega = 0.694781 e = 0.970579 l = 4.192916 mf = 0.646257 profit = 0.124910 investment = 0.285308 growth = 0.045103 inflation = 0.051236

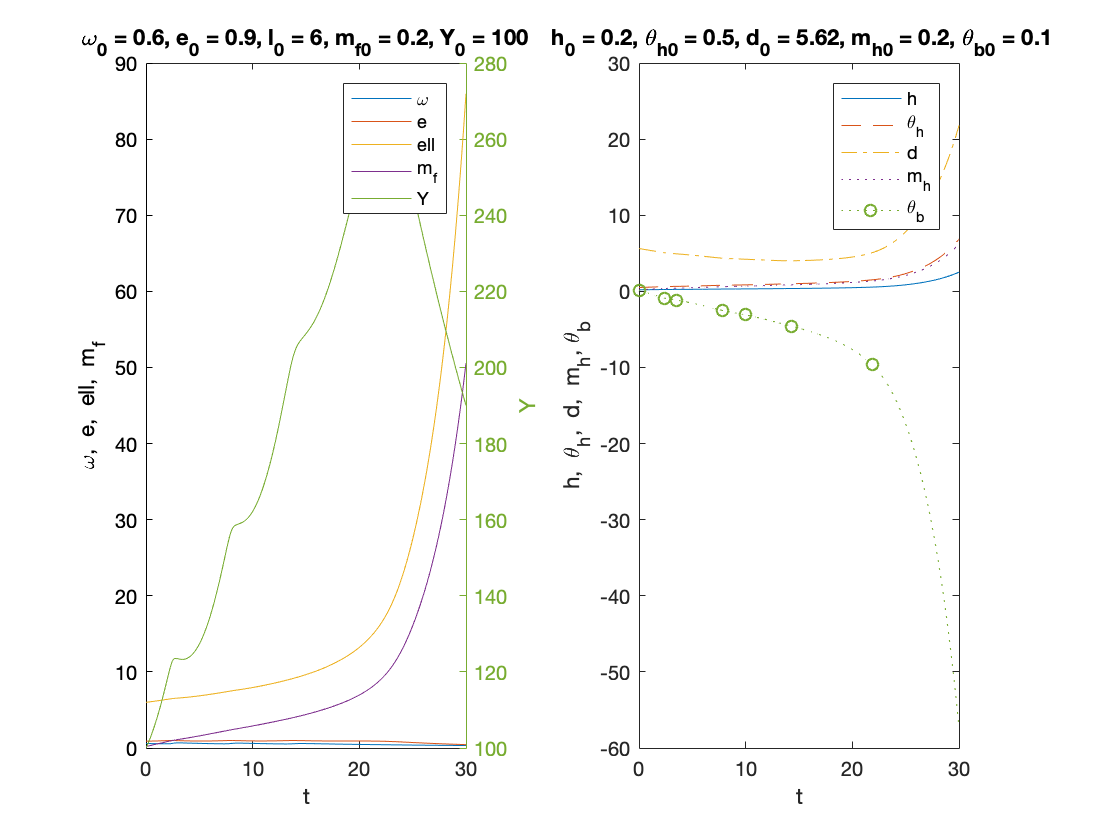

Example 4 - narrow banking with explosive equilibirum

fR = 1; % reserve ratio mf0 = 0.2; l0 = 6; d0 = (1-kr)*l0+thetab0; cf0 = r*l0-rm*mf0; T =30; y0=[convert([omega0,lambda0]),l0,mf0,h0,thetah0,thetab0,mh0,d0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); omega_sol=sol(:,1); lambda_sol=sol(:,2); l_sol=yK(:,3); mf_sol=yK(:,4); h_sol=yK(:,5); theta_h_sol=yK(:,6); theta_b_sol=yK(:,7); mh_sol=yK(:,8); d_sol=yK(:,9); profit_sol = 1-tax-omega_sol-r*l_sol+rm*mf_sol; Y_output = Y0*lambda_sol/lambda0.*exp((alpha+beta)*tK); xb=l_sol+fR*(mh_sol+mf_sol)+theta_b_sol-(d_sol+mh_sol+mf_sol); k_effective = xb./l_sol; n=length(yK(:,1)); omega_bar = omega_sol(n); lambda_bar = lambda_sol(n); l_bar = l_sol(n); mf_bar = mh_sol(n); profit_bar = profit_sol(n); investment_bar = investment(profit_bar); growth_bar = investment_bar/nu -delta; inflation_bar = inflation(omega_bar); F1=phillips(lambda_bar)-(1-gamma)*inflation_bar-alpha; F2=growth_bar-alpha-beta; F3=-(growth_bar+inflation_bar)*l_bar+investment_bar+r*l_bar; fprintf('\nExample 4 - narrow banking with explosive equilibirum \n') fprintf('omega = %f \n',omega_bar) fprintf('e = %f \n',lambda_bar) fprintf('l = %f \n',l_bar) fprintf('mf = %f \n',mf_bar) fprintf('profit = %f \n',profit_bar) fprintf('investment = %f \n',investment_bar) fprintf('growth = %f \n',growth_bar) fprintf('inflation = %f \n',inflation_bar) figure(4) subplot(1,2,1) plot(tK, omega_sol,tK,lambda_sol,tK,l_sol,tK,mf_sol) xlabel('t') ylabel('\omega, e, ell, m_f') yyaxis right plot(tK, Y_output) ylabel('Y') title(['\omega_0 = ', num2str(omega0,txt_format), ... ', e_0 = ', num2str(lambda0, txt_format), ... ', l_0 = ', num2str(l0, txt_format),... ', m_{f0} = ', num2str(mf0,txt_format),... ', Y_0 = ', num2str(Y0, txt_format)]) legend('\omega', 'e', 'ell', 'm_f','Y') %%%%%%%%%%% subplot(1,2,2) plot(tK,h_sol,tK,theta_h_sol,'--',tK,d_sol,'-.',tK,mh_sol,':',tK, theta_b_sol,':o','MarkerIndices',1:100:length(h_sol)) xlabel('t') ylabel('h, \theta_h, d, m_h, \theta_b') title([' h_0 = ', num2str(h0, txt_format),... ', \theta_{h0} = ', num2str(thetah0, txt_format),... ', d_0 = ', num2str(d0, txt_format),... ', m_{h0} = ', num2str(mh0,txt_format),... ', \theta_{b0} = ', num2str(thetab0,txt_format)]) legend('h','\theta_h','d', 'm_h','\theta_b') print('example4','-dpdf')

Example 4 - narrow banking with explosive equilibirum omega = 0.323247 e = 0.443312 l = 85.952861 mf = 6.240883 profit = -1.476233 investment = -0.006500 growth = -0.052167 inflation = -0.163325

Auxiliary functions

Instead of integrating the system in terms of omega, lambda and d, we decided to use:

log_omega = log(omega), tan_lambda = tan((lambda-0.5)*pi)

Experiments show that the numerical methods work better with these variables.

function new = convert(old) % This function converts % [omega, lambda] % to % [log_omega, tan_lambda] n = size(old,2); %number of variables new = zeros(size(old)); new(:,1) = log(old(:,1)); new(:,2) = tan((old(:,2)-0.5)*pi); end function old = retrieve(new) % This function retrieves [omega, lambda] % from % [log_omega, tan_lambda] n = size(new,2); %number of variables old = zeros(size(new)); old(:,1) = exp(new(:,1)); old(:,2) = atan(new(:,2))/pi+0.5; end function f = main(y) % solves the main dynamical system f = zeros(9,1); log_omega = y(1); tan_lambda = y(2); l = y(3); mf= y(4); h=y(5); theta_h = y(6); theta_b = y(7); m_h = y(8); d = y(9); lambda = atan(tan_lambda)/pi+0.5; omega = exp(log_omega); profit = 1-tax-omega-r*l+rm*mf; growth = investment(profit)/nu-delta; % real growth rate factor = g-tax-profit+rtheta*(theta_h+theta_b)+(1-kr)*investment(profit)-kr*r*l; % Equations (2.62), (2.67) and (2.70)-(2.72) f(1) = phillips(lambda)-(1-gamma)*inflation(omega)-alpha; %d(log_omega)/dt f(2) = (1+tan_lambda^2)*pi*lambda*(growth-alpha-beta); %d(tan_lambda)/dt f(3) = -(growth+inflation(omega))*l+investment(profit)+r*l; %d(l)/dt f(4) = -(growth+inflation(omega))*mf+profit+r*l; f(5) = -(growth+inflation(omega))*h+lambda00*factor; %dh/dt f(6) = -(growth+inflation(omega))*theta_h+lambda1*factor; %d(theta_h)/dt f(7) = -(growth+inflation(omega))*theta_b-(1-kr)*investment(profit)+(1-fR)*profit+(kr-fR)*r*l... +((1-fR)*lambda2+lambda3)*factor; %d(theta_b)/dt f(8) = -(growth+inflation(omega))*m_h+lambda2*factor; %d(m_h)/dt f(9) = -(growth+inflation(omega))*d+lambda3*factor; %d(d)/dt end

end