Contents

function out = keen_1995()

close all

clc

warning off

Parameters attribution and function definitions

par_alpha = 0.015;

par_beta = 0.035;

par_gamma = 0.02;

par_nu = 3;

par_A = 0.0000641;

par_D = 0.0400641;

fun_Phi = @(x) par_A./(1-x).^2- par_D;

fun_Phi_inv = @(y) 1 - sqrt(par_A./(y+par_D));

par_E = 0.0175 ;

par_F = 0.53;

par_G = 6;

par_H = 0.065;

fun_kappa = @(x) min(1,par_E./(par_F-(par_G/par_nu).*x).^2-par_H);

fun_kappa_inv = @(y) (par_nu/par_G)*(par_F-sqrt(par_E/(y+par_H)));

par_i = 0.05;

par_j = 1.2;

par_k = 4;

par_l = 0.05;

fun_Gamma = @(x) par_i./(par_j-par_k.*x).^2- par_l;

par_m = 0.0175;

par_n = 0.83;

par_o = 1.6014;

par_p = 0.039;

fun_Theta = @(x) par_m./(par_n-par_o.*x).^2- par_p;

TOL = 1E-7;

options = odeset('RelTol', TOL);

txt_format = '%3.3g';

Basic Goodwin limit cycle, page 617

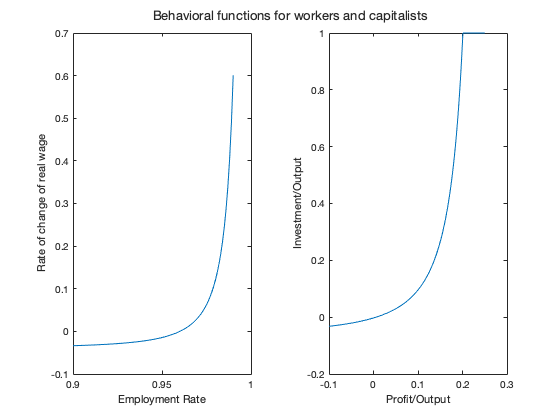

figure(1)

tiledlayout(1,2)

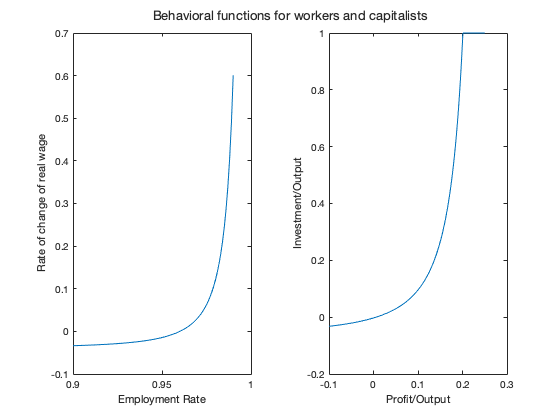

sgtitle('Behavioral functions for workers and capitalists')

nexttile

lambda_var=[0.9:0.001:0.99];

y1=fun_Phi(lambda_var);

plot(lambda_var,y1)

xlabel('Employment Rate')

ylabel('Rate of change of real wage')

nexttile

pi_var=[-0.1:0.001:0.25];

y2=fun_kappa(pi_var);

plot(pi_var,y2)

xlabel('Profit/Output')

ylabel('Investment/Output')

omega0 = 0.96;

lambda0 = 0.90;

T = 100;

lambda_bar = fun_Phi_inv(par_alpha);

omega_bar = 1-par_nu*(par_alpha+par_beta+par_gamma);

omega_mod = 1-fun_kappa_inv(par_nu*(par_alpha+par_beta+par_gamma));

par1 = [par_nu,par_alpha,par_beta,par_gamma,par_A,par_D];

par2 = [par_nu,par_alpha,par_beta,par_gamma,par_A,par_D,par_E,par_F,par_G,par_H];

[tG,yG] = ode15s(@(t,y) goodwin(y,par1), [0 T], [omega0, lambda0], options);

[tGmod,yGmod] = ode15s(@(t,y) goodwin_mod(y,par2), [0 T], [omega0, lambda0], options);

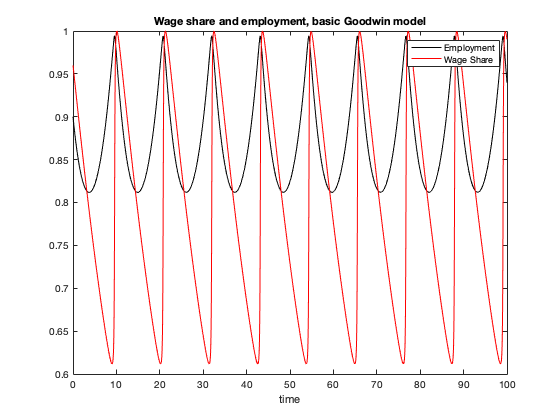

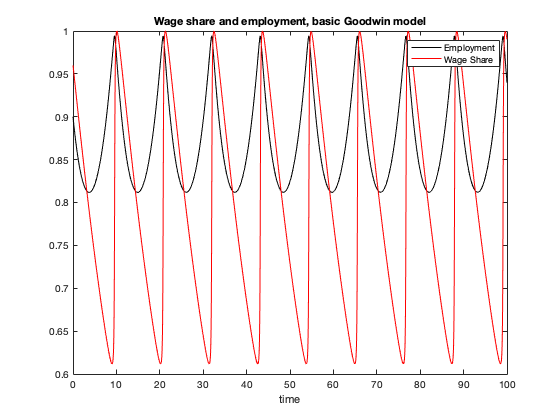

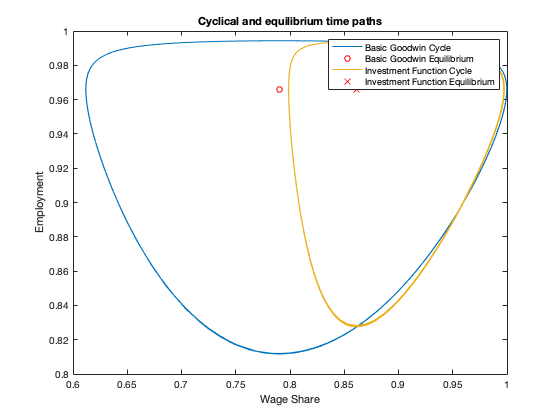

figure(2)

plot(tG, yG(:,2), 'k', tG, yG(:,1), 'r')

xlabel('time')

legend('Employment','Wage Share')

title(['Wage share and employment, basic Goodwin model'])

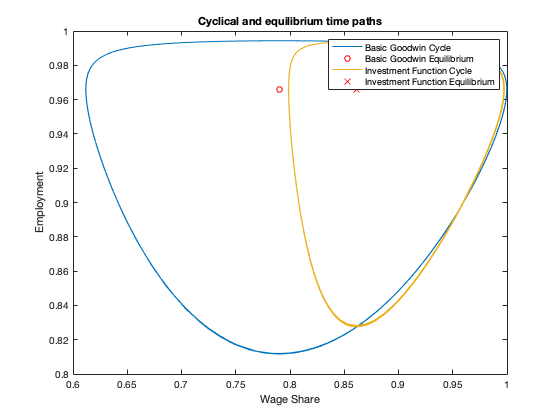

figure(3)

plot(yG(:,1), yG(:,2)), hold on;

plot(omega_bar, lambda_bar, 'ro')

plot(yGmod(:,1), yGmod(:,2))

plot(omega_mod, lambda_bar, 'rx')

legend('Basic Goodwin Cycle','Basic Goodwin Equilibrium','Investment Function Cycle',...

'Investment Function Equilibrium')

xlabel('Wage Share')

ylabel('Employment')

title(['Cyclical and equilibrium time paths'])

Base rate variations, page 620

par_xi = 0.036;

par_phi = 0;

kappa_eq = par_nu*(par_alpha+par_beta+par_gamma);

pi_eq=fun_kappa_inv(par_nu*(par_alpha+par_beta+par_gamma));

d_eq = (fun_kappa(pi_eq)-pi_eq-par_nu*par_gamma)/(par_alpha+par_beta-par_xi);

omega_eq = 1-pi_eq-par_xi*d_eq;

lambda_eq=fun_Phi_inv(par_alpha);

b_eq = par_xi*d_eq;

omega0 = 0.96;

lambda0 = 0.90;

d0 = 0.0;

y0 = [convert([omega0, lambda0]),d0];

T = 200;

par3 = [par_nu,par_alpha,par_beta,par_gamma,par_xi,par_phi,par_A,par_D,par_E,par_F,par_G,par_H];

[tK,yK] = ode15s(@(t,y) keen_wrong(y,par3), [0 T], y0, options);

yKnew = retrieve([yK(:,1),yK(:,2)]);

yK(:,1) = yKnew(:,1);

yK(:,2) = yKnew(:,2);

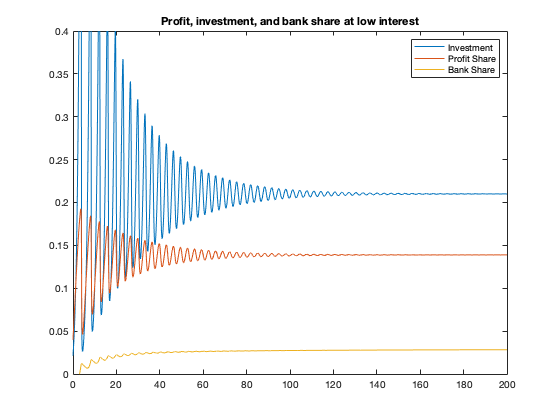

figure(4)

plot(tK, yK(:,2),tK,yK(:,1))

xlabel('time')

legend('Employment','Wage Share')

title(['Employment and wage share at low interest'])

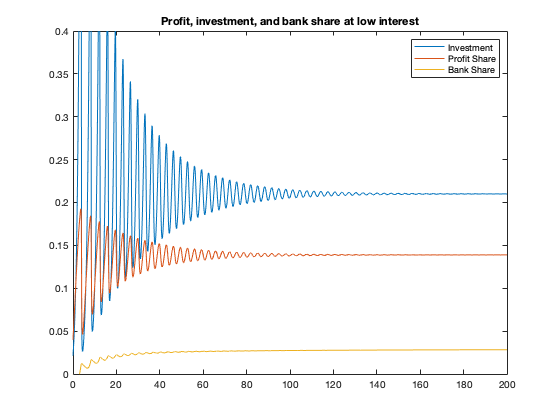

figure(5)

profit = 1-yK(:,1)-par_xi*yK(:,3);

invest = fun_kappa(profit);

bank = par_xi*yK(:,3);

plot(tK,invest,tK,profit,tK,bank)

legend('Investment','Profit Share','Bank Share')

ylim([0 0.4])

title(['Profit, investment, and bank share at low interest'])

figure(6)

plot3(yK(:,2),yK(:,1),bank)

xlabel('Employment')

ylabel('Wages')

zlabel('Bank Share')

title(['Income and interest stability at low interest'])

par_xi = 0.04626;

par_phi = 0;

kappa_eq = par_nu*(par_alpha+par_beta+par_gamma);

pi_eq=fun_kappa_inv(par_nu*(par_alpha+par_beta+par_gamma));

d_eq = (fun_kappa(pi_eq)-pi_eq-par_nu*par_gamma)/(par_alpha+par_beta-par_xi);

omega_eq = 1-pi_eq-par_xi*d_eq;

lambda_eq=fun_Phi_inv(par_alpha);

b_eq = par_xi*d_eq;

omega0 = 0.96;

lambda0 = 0.90;

d0 = 0.0;

y0 = [convert([omega0, lambda0]),d0];

T = 1000;

par4 = [par_nu,par_alpha,par_beta,par_gamma,par_xi,par_phi,par_A,par_D,par_E,par_F,par_G,par_H];

[tK,yK] = ode15s(@(t,y) keen_wrong(y,par4), [0 T], y0, options);

yKnew = retrieve([yK(:,1),yK(:,2)]);

yK(:,1) = yKnew(:,1);

yK(:,2) = yKnew(:,2);

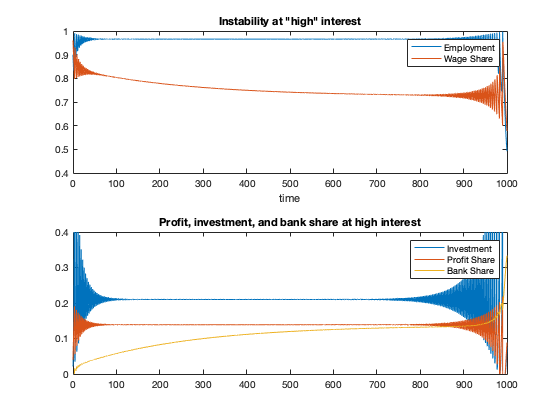

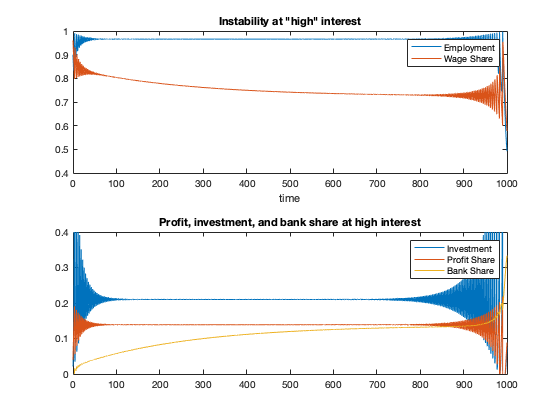

figure(7)

tiledlayout(2,1)

nexttile

plot(tK, yK(:,2),tK,yK(:,1))

xlabel('time')

legend('Employment','Wage Share')

title(['Instability at "high" interest'])

nexttile

profit = 1-yK(:,1)-par_xi*yK(:,3);

invest = fun_kappa(profit);

bank = par_xi*yK(:,3);

plot(tK,invest,tK,profit,tK,bank)

legend('Investment','Profit Share','Bank Share')

ylim([0 0.4])

title(['Profit, investment, and bank share at high interest'])

figure(8)

plot3(yK(:,2),yK(:,1),bank)

xlabel('Employment')

ylabel('Wage Share')

zlabel('Bank Share')

title(['Instability at "high" interest'])

Debt sensitivity variations, page 623

par_xi = 0.0459;

par_phi = 0.0022;

omega0 = 0.96;

lambda0 = 0.90;

d0 = 0.0;

y0 = [convert([omega0, lambda0]),d0];

T = 300;

par5 = [par_nu,par_alpha,par_beta,par_gamma,par_xi,par_phi,par_A,par_D,par_E,par_F,par_G,par_H];

[tK,yK] = ode15s(@(t,y) keen_wrong(y,par5), [0 T], y0, options);

yKnew = retrieve([yK(:,1),yK(:,2)]);

yK(:,1) = yKnew(:,1);

yK(:,2) = yKnew(:,2);

figure(9)

tiledlayout(2,1)

nexttile

plot(tK, yK(:,2),tK,yK(:,1))

xlabel('time')

legend('Employment','Wage Share')

title(['Debt sensitivity driven crisis'])

nexttile

profit = 1-yK(:,1)-(par_xi+par_phi*yK(:,3)).*yK(:,3);

invest = fun_kappa(profit);

bank = (par_xi+par_phi*yK(:,3)).*yK(:,3);

plot(tK,invest,tK,profit,tK,bank)

legend('investment','profit','bank share')

ylim([0 0.4])

title(['Profit, investment, and bank share at low interest, high sensitivity'])

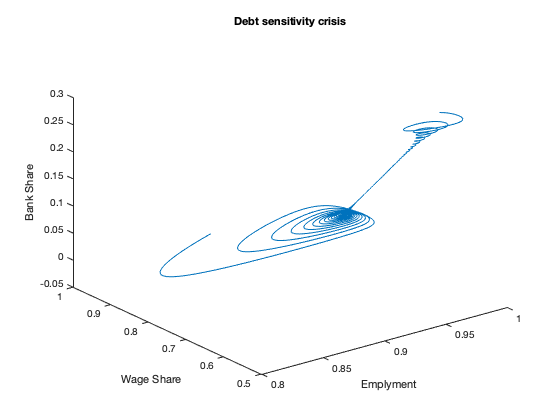

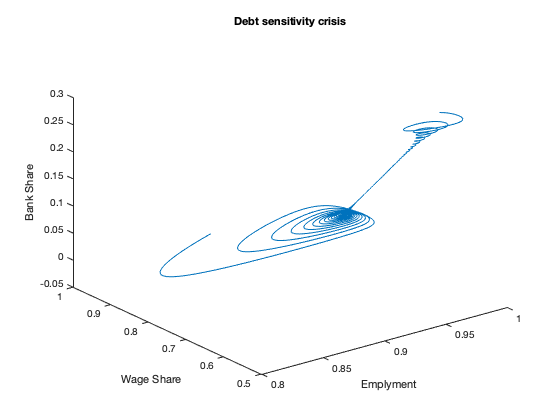

figure(10)

plot3(yK(:,2),yK(:,1),bank)

xlabel('Emplyment')

ylabel('Wage Share')

zlabel('Bank Share')

title(['Debt sensitivity crisis'])

Minskian government, page 625

figure(11)

lambda_var = [0.8:0.01:1];

y3 = fun_Gamma(1-lambda_var);

pi_var = [-0.3:0.01:0.3];

y4 = fun_Theta(pi_var);

tiledlayout(1,2)

sgtitle('Government behavioral functions')

nexttile

plot(lambda_var,y3)

xlabel('Employment rate')

ylabel('Rate of change of government subsidy')

nexttile

plot(pi_var,y4)

xlabel('Gross Profit/Output')

ylabel('Rate of change of taxes')

omega0 = 0.96;

lambda0 = 0.90;

dk0 = 0;

dg0 = 0;

g0 = 0;

t0 = 0;

par_xi = 0.05;

par_phi = 0.005;

y0 = [convert([omega0, lambda0]),dk0,dg0,g0,t0];

T = 350;

par6 = [par_nu,par_alpha,par_beta,par_gamma,par_xi,par_phi,par_A,par_D,par_E,par_F,par_G,par_H,...

par_i,par_j,par_k,par_l,par_m,par_n,par_o,par_p];

[tG,yG] = ode15s(@(t,y) keen_government(y,par6), [0 T], y0, options);

yGnew = retrieve([yG(:,1),yG(:,2)]);

yG(:,1) = yGnew(:,1);

yG(:,2) = yGnew(:,2);

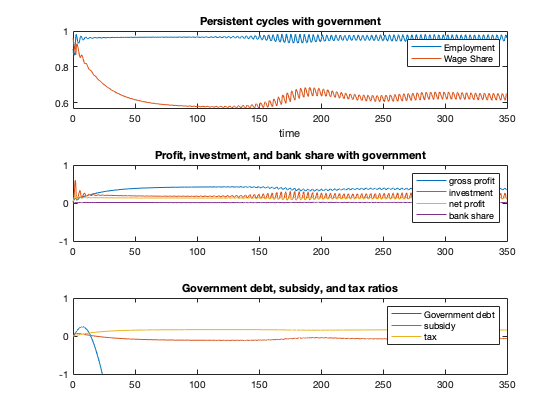

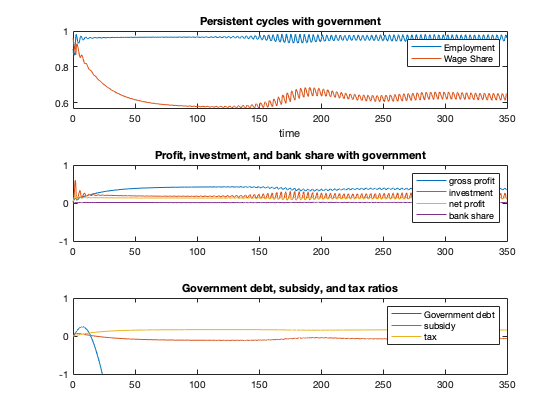

figure(12)

tiledlayout(3,1)

nexttile

plot(tG, yG(:,2),tG,yG(:,1))

xlabel('time')

legend('Employment','Wage Share')

title(['Persistent cycles with government'])

nexttile

profit = 1-yG(:,1)-(par_xi+par_phi*yG(:,3)).*yG(:,3)+yG(:,5)-yG(:,6);

gross_profit = 1-yG(:,1);

invest = fun_kappa(profit);

bank = (par_xi+par_phi*yG(:,3)).*yG(:,3);

plot(tG,gross_profit,tG,invest,tG,profit,tG,bank)

legend('gross profit','investment','net profit','bank share')

title(['Profit, investment, and bank share with government'])

ylim([-1,1])

nexttile

plot(tG, yG(:,4),tG,yG(:,5),tG,yG(:,6))

legend('Government debt','subsidy','tax')

title(['Government debt, subsidy, and tax ratios'])

ylim([-1,1])

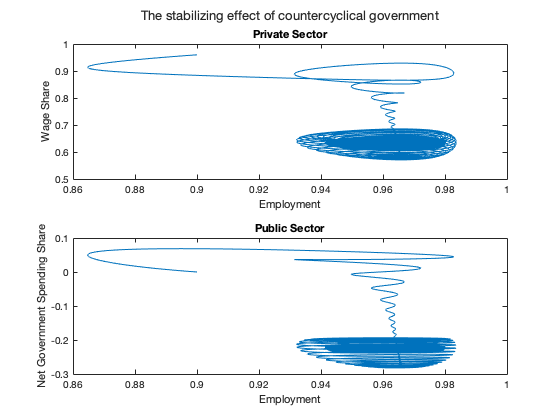

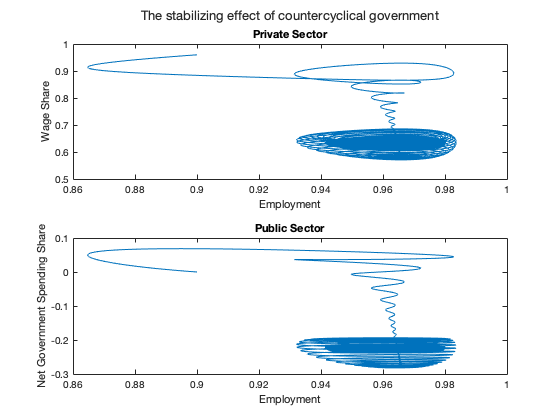

figure(13)

tiledlayout(2,1)

sgtitle(['The stabilizing effect of countercyclical government'])

nexttile

plot(yG(:,2), yG(:,1))

ylabel('Wage Share')

xlabel('Employment')

title(['Private Sector'])

nexttile

net_government = yG(:,5)-yG(:,6);

plot(yG(:,2), net_government)

ylabel('Net Government Spending Share')

xlabel('Employment')

title(['Public Sector'])

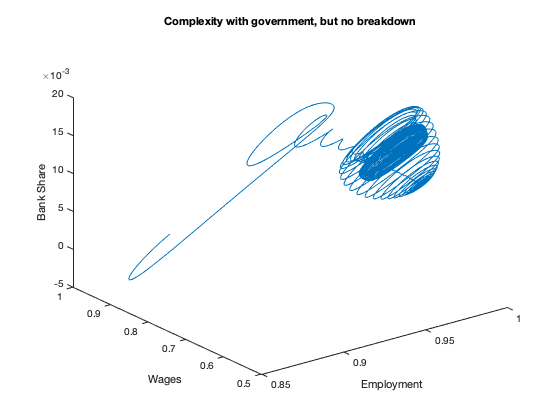

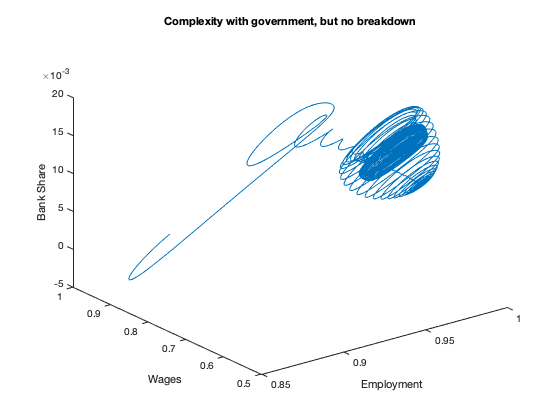

figure(14)

plot3(yG(:,2),yG(:,1),bank)

xlabel('Employment')

ylabel('Wages')

zlabel('Bank Share')

title(['Complexity with government, but no breakdown'])

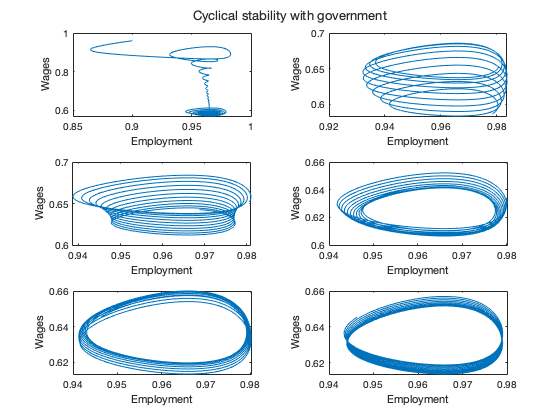

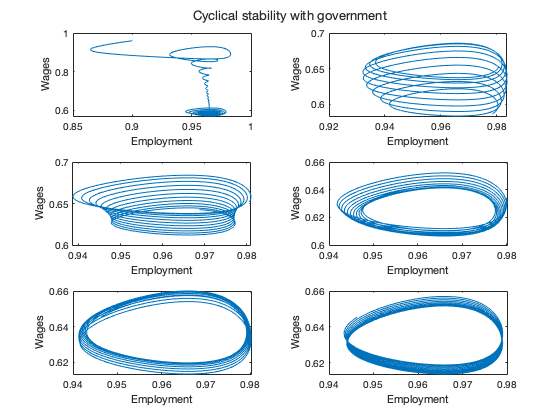

figure(15)

step=round(length(tG)/7);

tiledlayout(3,2)

sgtitle(['Cyclical stability with government'])

nexttile

plot(yG(1:2*step,2),yG(1:2*step,1))

xlabel('Employment')

ylabel('Wages')

nexttile

plot(yG(2*step:3*step,2),yG(2*step:3*step,1))

xlabel('Employment')

ylabel('Wages')

nexttile

plot(yG(3*step:4*step,2),yG(3*step:4*step,1))

xlabel('Employment')

ylabel('Wages')

nexttile

plot(yG(4*step:5*step,2),yG(4*step:5*step,1))

xlabel('Employment')

ylabel('Wages')

nexttile

plot(yG(5*step:6*step,2),yG(5*step:6*step,1))

xlabel('Employment')

ylabel('Wages')

nexttile

plot(yG(6*step:7*step,2),yG(6*step:7*step,1))

xlabel('Employment')

ylabel('Wages')

Auxiliary functions

function f = goodwin(y,par)

f = zeros(2,1);

omega = y(1);

lambda = y(2);

nu = par(1);

alpha = par(2);

beta = par(3);

gamma = par(4);

A = par(5);

D = par(6);

phillips = A./(1-lambda)^2- D;

f(1) = omega*(phillips-alpha);

f(2) = lambda*((1-omega)/nu-alpha-beta-gamma);

end

function f = goodwin_mod(y,par)

f = zeros(2,1);

omega = y(1);

lambda = y(2);

nu = par(1);

alpha = par(2);

beta = par(3);

gamma = par(4);

A = par(5);

D = par(6);

E = par(7);

F = par(8);

G = par(9);

H = par(10);

phillips = A./(1-lambda)^2- D;

kappa = E./(F-(G/nu).*(1-omega)).^2-H;

f(1) = omega*(phillips-alpha);

f(2) = lambda*(kappa/nu-alpha-beta-gamma);

end

function new = convert(old,r)

n = size(old,2);

new = zeros(size(old));

new(:,1) = log(old(:,1));

new(:,2) = tan((old(:,2)-0.5)*pi);

if n>2

new(:,3) = 1-old(:,1)-r*old(:,3);

if n==4

new(:,4) = log(old(:,4));

end

end

end

function old = retrieve(new,r)

n = size(new,2);

old = zeros(size(new));

old(:,1) = exp(new(:,1));

old(:,2) = atan(new(:,2))/pi+0.5;

if n>2

old(:,3) = (1-old(:,1)-new(:,3))/r;

if n==4

old(:,4) = exp(new(:,4));

end

end

end

function f = keen_wrong(y,par)

f = zeros(3,1);

log_omega = y(1);

tan_lambda = y(2);

d = y(3);

lambda = atan(tan_lambda)/pi+0.5;

omega = exp(log_omega);

nu = par(1);

alpha = par(2);

beta = par(3);

gamma = par(4);

xi = par(5);

phi = par(6);

A = par(7);

D = par(8);

E = par(9);

F = par(10);

G = par(11);

H = par(12);

r = xi+phi*d;

pi_n = 1-omega-r*d;

phillips = A./(1-lambda)^2- D;

kappa = E./(F-(G/nu).*pi_n).^2-H;

g_Y = kappa/nu-gamma;

f(1) = phillips-alpha;

f(2) = (1+tan_lambda^2)*pi*lambda*(g_Y-alpha-beta);

f(3) = r*d-pi_n+(nu-d)*(kappa/nu-gamma);

end

function f = keen_government(y,par)

f = zeros(6,1);

log_omega = y(1);

tan_lambda = y(2);

dk = y(3);

dg = y(4);

g = y(5);

t = y(6);

lambda = atan(tan_lambda)/pi+0.5;

omega = exp(log_omega);

nu = par(1);

alpha = par(2);

beta = par(3);

gamma = par(4);

xi = par(5);

phi = par(6);

A = par(7);

D = par(8);

E = par(9);

F = par(10);

G = par(11);

H = par(12);

i = par(13);

j = par(14);

k = par(15);

l = par(16);

m = par(17);

n = par(18);

o = par(19);

p = par(20);

r = xi+phi*(dk+dg);

pi_n = 1-omega-r.*dk+g-t;

phillips = A./(1-lambda)^2- D;

kappa = E./(F-(G/nu).*pi_n).^2-H;

Gamma = i./(j-k.*(1-lambda)).^2-l;

Theta = m./(n-o.*pi_n).^2-p;

g_Y = kappa/nu-gamma;

f(1) = phillips-alpha;

f(2) = (1+tan_lambda^2)*pi*lambda*(g_Y-alpha-beta);

f(3) = r*dk-(1-omega)+t-g+(nu-dk)*(kappa/nu-gamma);

f(4) = r*dg-dg*(kappa/nu-gamma)+g-t;

f(5) = Gamma - g*(kappa/nu-gamma);

f(6) = Theta - t*(kappa/nu-gamma);

end

end